city of loveland co sales tax

The average cumulative sales tax rate in Loveland Colorado is 67. 80537 80538 and 80539.

Because of the different cities and taxing jurisdictions within Larimer county the sales tax rates will vary.

. There is a one-time processing fee of 25 which may be paid by cash or check. In addition the City of Loveland agreed to reduce the city sales tax rate within these areas from 30 to 175. Real property tax on median home.

View the amount of tax calculated by purchase amounts from 001 through 100 and search local sales tax rates by a specific address. This is an opportunity in a small department with varied responsibilities. Because the PIF and RSF are taxable they become a part of the purchase price and cannot be added in to the tax rates which results in a formula of 7823.

Reserve a Meeting Room at the Chilson Center. An alternative sales tax rate of 765 applies in the tax region Windsor which appertains to zip code 80538. This rate includes any state county city and local sales taxes.

House of Neighborly Service The Life Center 1511 E. There are approximately 69796 people living in. To view Building Permits click Public Access from the choices on the left no login credentials needed For Sales Tax please provide email login and password.

388 - City and MRD 358 City and 3 MRD 175 - Montrose County. The sales tax rate does not vary based on zip code. The city of Loveland is asking voters to approve a 1 sales and use tax increase excluding food bought for home consumption which would remain taxed at the current rate.

This rate includes any state county city and local sales taxes. This video explains sales tax in Loveland Colorado. The Loveland Colorado sales tax is 655 consisting of 290 Colorado state sales tax and 365 Loveland local sales taxesThe local sales tax consists of a 065 county sales tax and a 300 city sales tax.

The Loveland Colorado sales tax is 655 consisting of 290 Colorado state sales tax and 365 Loveland local sales taxesThe local sales tax consists of a 065 county sales tax and a 300 city sales tax. Current Sales Tax Rates. The amount due is a percentage of the purchase price and is based on the taxing jurisdiction of the buyer and seller.

Help us make this site better by reporting errors. For assistance please contact the Sales Tax Office at 303-651-8672 or email SalesTaxLongmontColoradogov. The Loveland Sales Tax is collected by the merchant on all qualifying sales made within Loveland.

The latest sales tax rate for Loveland CO. For more information regarding these fees please contact the Revenue Licensing Agent at 9709622708 or e-mail. View sales tax rates applicable to your specific business location s.

Within Loveland there are around 3 zip codes with the most populous zip code being 80538. Fast Easy Tax Solutions. Groceries are exempt from the Loveland.

Ad Find Out Sales Tax Rates For Free. Start Move or Expand Your Business. 2020 rates included for use while preparing your income tax deduction.

On January 1 2020 the City of Montrose began collecting the 058 Public Safety Sales Tax that was approved by voters in November 2019. City of Loveland 175. The sales and use tax rates for retail sales in the city are.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. 11th Street Loveland CO City of Loveland 500 E Third Street Utility Billing in front of cashier Loveland CO Loveland Public Library 300 N. This includes the rates on the state county city and special levels.

Sales tax rates are also available in the Colorado. Loveland is located within Larimer County Colorado. An alternative sales tax rate of 77 applies in the tax region Berthoud which appertains to zip code 80537.

Pay My City Sales Tax. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. Sales taxes are due one time after a new or used vehicle purchase at the time your vehicle is titled.

Always consult your local government tax offices for the latest official city county and state tax rates. State of Colorado 29. The Loveland Colorado sales tax rate of 67 applies to the following three zip codes.

Third Street Loveland CO 80537 Phone. Return the completed form in person 8-5 M-F or by mail. This program issues food sales tax rebates to individuals and families who qualify according to HUD income guidelines.

Ad New State Sales Tax Registration. View sales tax rates by specific city or county. The Loveland Colorado sales tax rate of 67 applies to the following three zip codes.

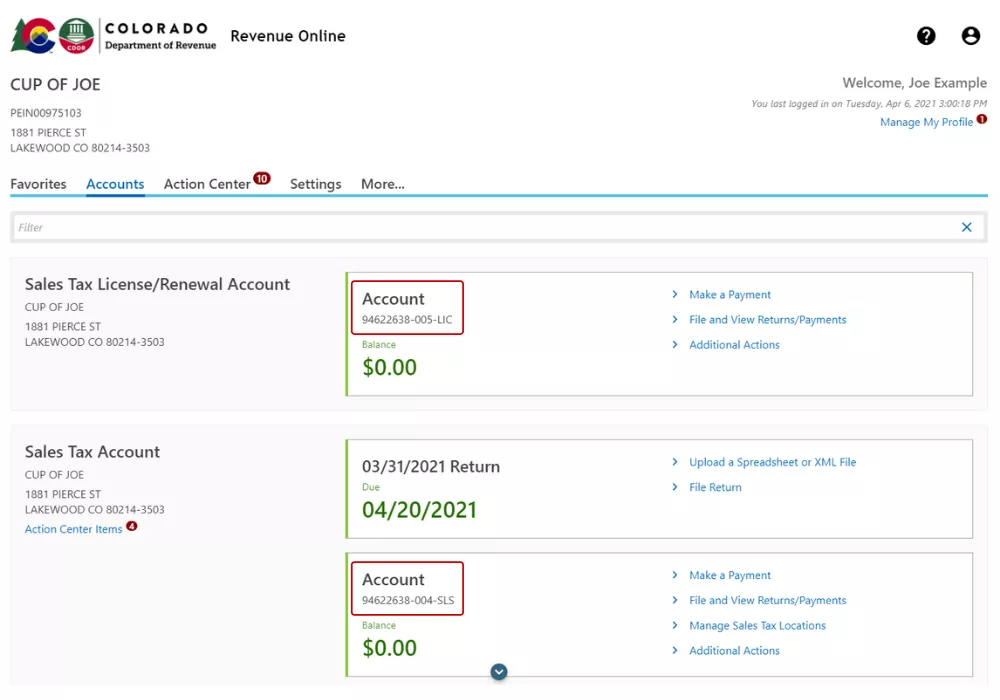

Through Revenue Online you can also. Sales Tax State Local Sales Tax on Food. Co Sales Tax information registration support.

Reserve a Meeting Room at the Public Library. Due to a planned power outage on Friday 114 between 8am-1pm PST some services may be impacted. 80537 80538 and 80539.

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Loveland Wants Colorado To Settle Netflix Sales Tax Issue Loveland Reporter Herald

My Account Portal City Of Loveland

Sales Tax Filing Information Department Of Revenue Taxation

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Real Estate Search Results Warren County Ohio Real Estate For Sale

Colorado Retailers Get Break With Signing Of New Sales Tax Law Denver Business Journal

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Renew Your Sales Tax License Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Springboro S The Cove Patio Home Community Part Of Settler S Walk Upscale Patio Homes Including Custom New Construction Patio Ohio Real Estate Springboro